Kansas Sales Tax Instructions . When a kansas individual or business buys goods from a retailer in another state for use, storage, or consumption (and not for resale) in kansas, on. Write your tax account number on your check or money order and make payable to retailers’ sales tax. As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Total net tax deduction add lines 5 and 6. The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. Kansas retailers’ sales tax return: Total number of supplemental pages included with this return. Tired of paper and postage? Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Send your return and payment to:

from ahmedgirard.blogspot.com

Send your return and payment to: The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Total number of supplemental pages included with this return. Total net tax deduction add lines 5 and 6. Tired of paper and postage? When a kansas individual or business buys goods from a retailer in another state for use, storage, or consumption (and not for resale) in kansas, on. Write your tax account number on your check or money order and make payable to retailers’ sales tax. Kansas retailers’ sales tax return:

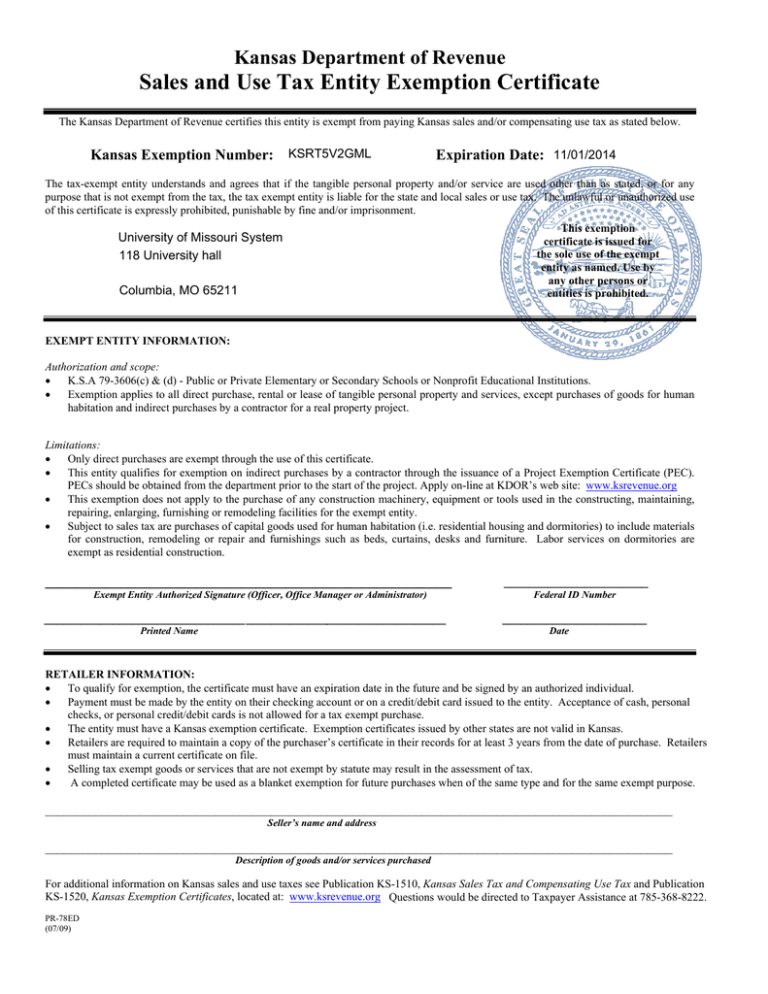

kansas sales and use tax exemption form Ahmed Girard

Kansas Sales Tax Instructions As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Total number of supplemental pages included with this return. Total net tax deduction add lines 5 and 6. As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. Write your tax account number on your check or money order and make payable to retailers’ sales tax. Kansas retailers’ sales tax return: Send your return and payment to: Tired of paper and postage? Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. When a kansas individual or business buys goods from a retailer in another state for use, storage, or consumption (and not for resale) in kansas, on.

From polstontax.com

Kansas Sales Tax Guide for Businesses Polston Tax Kansas Sales Tax Instructions Kansas retailers’ sales tax return: Total number of supplemental pages included with this return. Total net tax deduction add lines 5 and 6. As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Tired of paper and postage? The kansas sales tax handbook provides everything. Kansas Sales Tax Instructions.

From www.kmuw.org

Kansas Sales Tax Pushes Shoppers Across State, County Lines KMUW Kansas Sales Tax Instructions Write your tax account number on your check or money order and make payable to retailers’ sales tax. The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. When a kansas individual or business buys goods from a retailer in another state for use, storage, or consumption (and not. Kansas Sales Tax Instructions.

From blog.accountingprose.com

Kansas Sales Tax Guide Kansas Sales Tax Instructions Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Total number of supplemental pages included with this return. Total net tax deduction add lines 5 and 6. Write your tax account number on your check or money order and make payable to retailers’ sales tax. Tired of paper and postage?. Kansas Sales Tax Instructions.

From www.exemptform.com

Kansas Sales And Use Tax Exemption Form Kansas Sales Tax Instructions Tired of paper and postage? Write your tax account number on your check or money order and make payable to retailers’ sales tax. Total net tax deduction add lines 5 and 6. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. The kansas sales tax handbook provides everything you need. Kansas Sales Tax Instructions.

From fill.io

Fill Free fillable Kansas Department of Revenue PDF forms Kansas Sales Tax Instructions Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Write your tax account number on your check or money order and make payable to retailers’. Kansas Sales Tax Instructions.

From kansaspolicy.org

Tax Cuts and the Kansas Economy Kansas Policy Institute Kansas Sales Tax Instructions Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. When a kansas individual or business buys goods from a retailer in another state for use,. Kansas Sales Tax Instructions.

From ahmedgirard.blogspot.com

kansas sales and use tax exemption form Ahmed Girard Kansas Sales Tax Instructions As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Write your tax account number on your check or money order and make payable to retailers’ sales tax. When a kansas individual or business buys goods from a retailer in another state for use, storage,. Kansas Sales Tax Instructions.

From www.adamsbrowncpa.com

Kansas Sales Tax Update Remote Seller Guidance Wichita CPA Kansas Sales Tax Instructions Write your tax account number on your check or money order and make payable to retailers’ sales tax. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Total net tax deduction add lines 5 and 6. As a business owner selling taxable goods or services, you act as an agent. Kansas Sales Tax Instructions.

From www.formsbank.com

Form St36 Kansas Retailer'S Sales Tax Return printable pdf download Kansas Sales Tax Instructions Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Total number of supplemental pages included with this return. The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. Tired of paper and postage? As a business owner selling taxable. Kansas Sales Tax Instructions.

From www.uslegalforms.com

Kansas Retailers Sales Tax Return St 36 Fill and Sign Printable Kansas Sales Tax Instructions The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. Send your return and payment to: Tired of paper and postage? Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. When a kansas individual or business buys goods from. Kansas Sales Tax Instructions.

From adelinelindquist.blogspot.com

kansas sales tax exemption certificate Adeline Lindquist Kansas Sales Tax Instructions Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. Tired of paper and postage? As a business owner selling taxable goods or services, you act as an agent of. Kansas Sales Tax Instructions.

From www.cybrosys.com

How to Use Kansas(USA) Sales Tax in the Odoo 16 Accounting? Kansas Sales Tax Instructions Total net tax deduction add lines 5 and 6. When a kansas individual or business buys goods from a retailer in another state for use, storage, or consumption (and not for resale) in kansas, on. Send your return and payment to: Kansas retailers’ sales tax return: The kansas sales tax handbook provides everything you need to understand the kansas sales. Kansas Sales Tax Instructions.

From www.salestaxsolutions.us

Sales Tax In Kansas State Of Kansas Sales Tax Filing Kansas Sales Tax Instructions Send your return and payment to: Tired of paper and postage? Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. Kansas retailers’ sales tax return: As a business owner. Kansas Sales Tax Instructions.

From genealogicalcollections.blogspot.com

kansas sales tax exemption certificate Loudly Diary Image Library Kansas Sales Tax Instructions Total net tax deduction add lines 5 and 6. Total number of supplemental pages included with this return. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Kansas retailers’ sales tax return: As a business owner selling taxable goods or services, you act as an agent of the state of. Kansas Sales Tax Instructions.

From carriagehouseplanswallpaper.blogspot.com

Carriage House Plans Kansas Sales Tax Kansas Sales Tax Instructions Kansas retailers’ sales tax return: Total number of supplemental pages included with this return. Tired of paper and postage? Write your tax account number on your check or money order and make payable to retailers’ sales tax. The kansas sales tax handbook provides everything you need to understand the kansas sales tax as a consumer or business owner,. As a. Kansas Sales Tax Instructions.

From www.adamsbrowncpa.com

Kansas Sales Tax Update Remote Seller Guidance Wichita CPA Kansas Sales Tax Instructions Send your return and payment to: As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Total net tax deduction add lines 5 and 6. Total number of supplemental pages included with this return. Write your tax account number on your check or money order. Kansas Sales Tax Instructions.

From silvanascully.blogspot.com

kansas sales and use tax exemption form Silvana Scully Kansas Sales Tax Instructions Kansas retailers’ sales tax return: Total number of supplemental pages included with this return. Total net tax deduction add lines 5 and 6. As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. Write your tax account number on your check or money order and. Kansas Sales Tax Instructions.

From www.pdffiller.com

Fillable Online Printable Kansas Sales Tax Exemption Kansas Sales Tax Instructions Total net tax deduction add lines 5 and 6. Kansas retailers’ sales tax return: As a business owner selling taxable goods or services, you act as an agent of the state of kansas by collecting tax from purchasers and. When a kansas individual or business buys goods from a retailer in another state for use, storage, or consumption (and not. Kansas Sales Tax Instructions.